Tax Brackets 2025. Get the information about the old and new income tax slabs for individuals, senior citizens and super senior citizens on groww. The union budget 2025 should focus on offering relief to taxpayers, especially in the lower income brackets, to stimulate consumption, industry players suggested.

Earn up to $18,200 — pay no tax; Check here for the latest income tax slabs & details of different income tax regimes for tax slabs in india.

Check here for the latest income tax slabs & details of different income tax regimes for tax slabs in india.

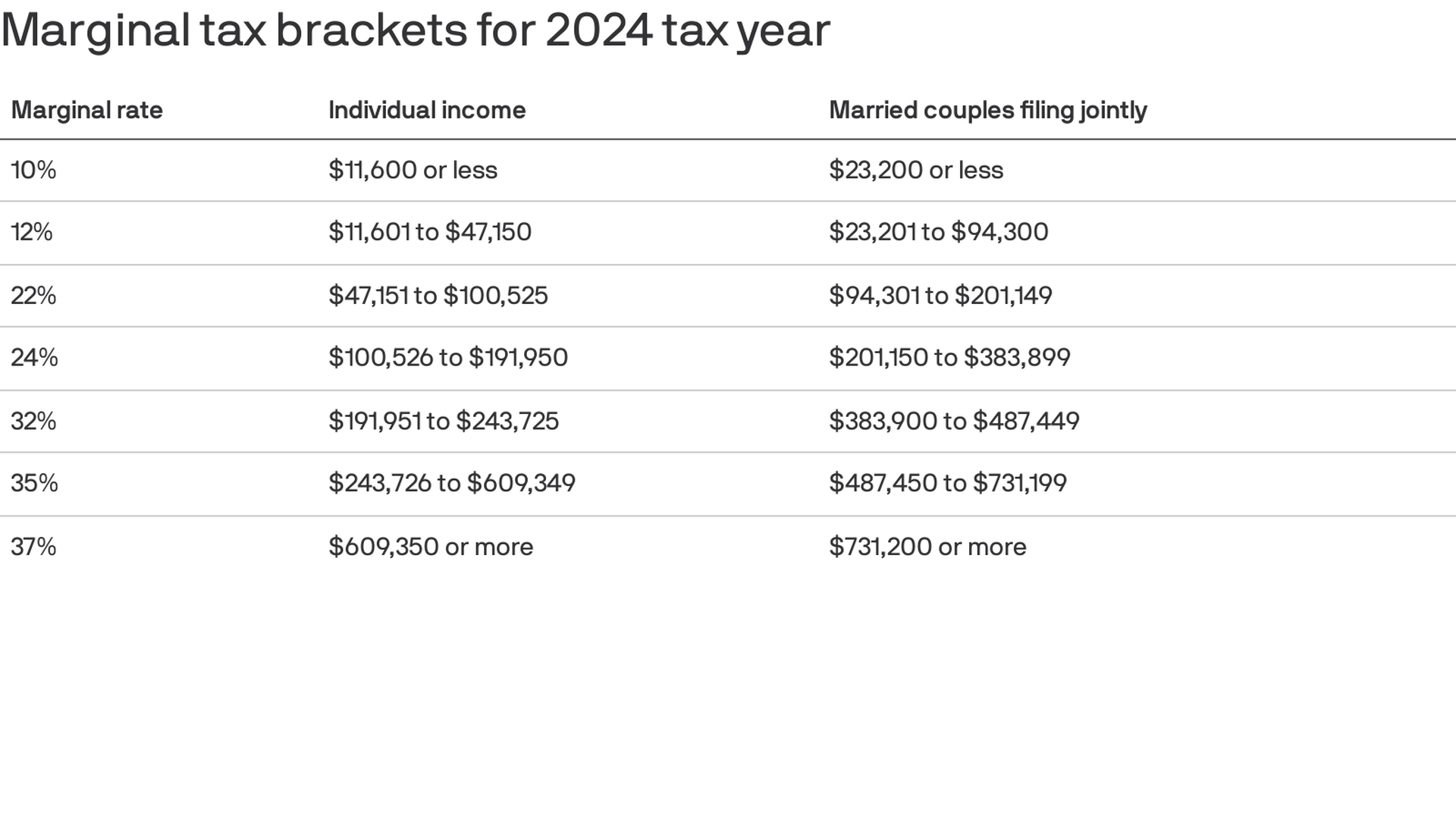

2025 Tax Code Changes Everything You Need To Know, 10%, 12%, 22%, 24%, 32%, 35% and. Get the information about the old and new income tax slabs for individuals, senior citizens and super senior citizens on groww.

Tax Brackets 2025 Australia Calculator Erinn Emmaline, The basic exemption limit depends on the age of an individual and status of an individual under the old tax regime. An individual has to choose between new and old tax regime to calculate their income tax liability, subject to certain conditions.

2025 Tax Brackets Aarp Members Etti Olivie, A handful of tax provisions, including the standard deduction and tax brackets, will see new. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Federal Pay Raise 2025 Calculator Esta Olenka, Tax brackets and tax rates. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Irs Tax Brackets 2025 Federal Ella Nikkie, The internal revenue service (irs) has released adjustments to tax brackets for 2025, adding thousands of dollars to most marginal tax brackets, and potentially protecting more of your income from taxes next year. The federal income tax has seven tax rates in 2025:

Tax Brackets 2025 For Single Person Drusy Sharon, The federal income tax has seven tax rates in 2025: Check here for the latest income tax slabs & details of different income tax regimes for tax slabs in india.

Tax Brackets 2025 Vs 2025 Ny Norri Annmarie, The union budget 2025 should focus on offering relief to taxpayers, especially in the lower income brackets, to stimulate consumption, industry players suggested. 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

IRS Tax Brackets 2025 Table Federal Withholding Tables 2025, The union budget 2025 should focus on offering relief to taxpayers, especially in the lower income brackets, to stimulate consumption, industry players suggested. The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

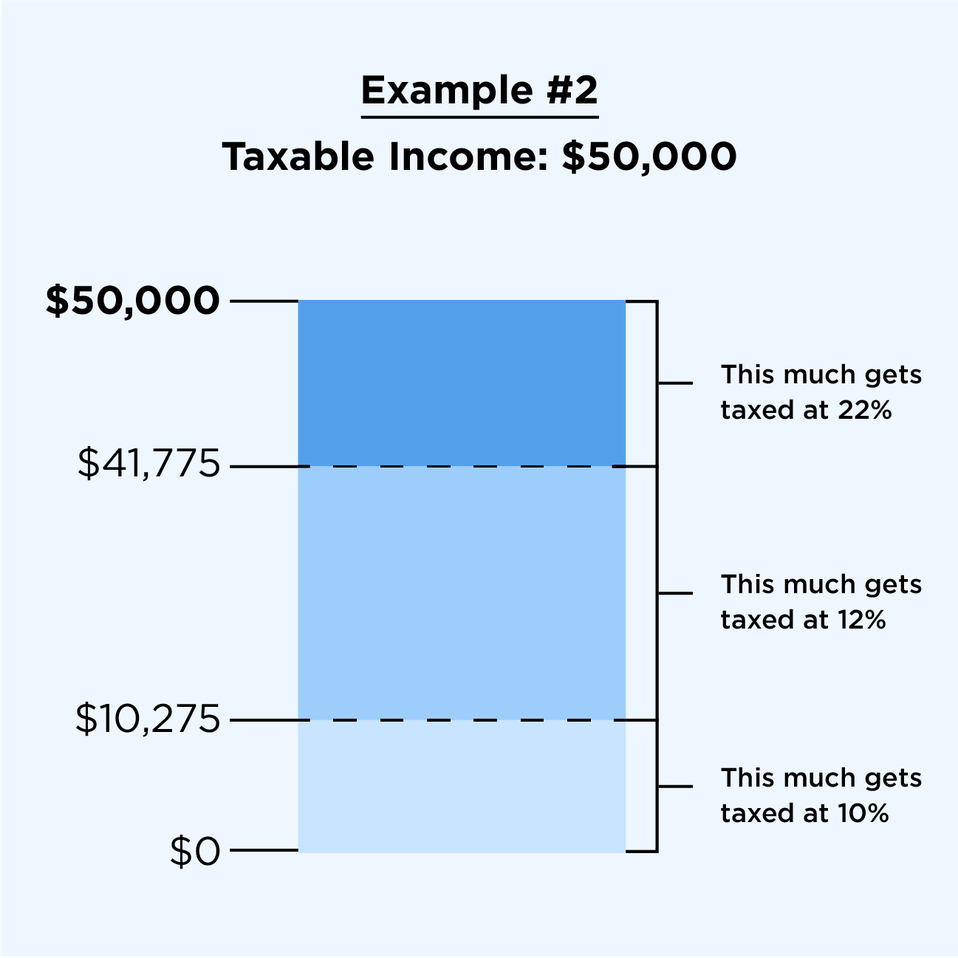

20232024 Tax Brackets and Federal Tax Rates NerdWallet, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax years. Earn up to $18,200 — pay no tax;

The Ultimate Guide to Canadian Tax Brackets 2025, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Also, check the updated tax slabs for individuals.

Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate returns, and estates and trusts.